A Practical Guide to Using Stop-Loss Orders in Your Trading

Trading in financial markets requires more than intuition and timing. It requires a structured approach to risk and a clear plan for protecting capital, especially during periods of volatility. One of the most essential tools for managing risk is the stop-loss order. Whether you are new to markets or a seasoned trader looking to refine your strategy, understanding how to use stop-loss orders effectively can make a noticeable difference in your overall performance.

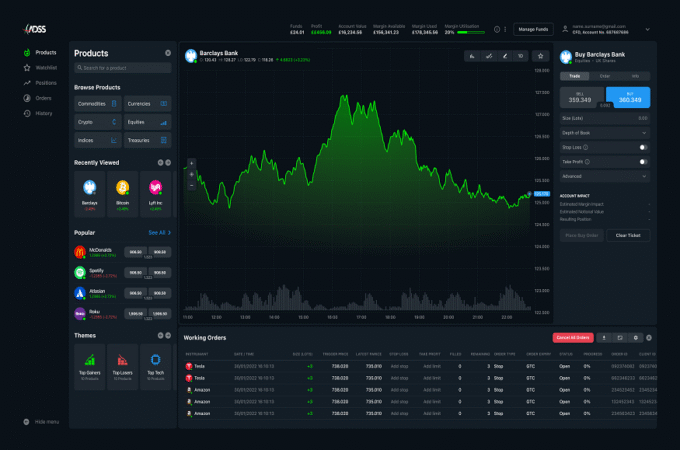

A stop-loss order helps traders limit potential losses on a position by automatically closing a trade when the price moves against them by a predetermined amount. It may sound simple, but using stop-loss orders well involves thoughtful planning, clear objectives, and an understanding of how markets behave. This practical guide explores the foundations of stop-loss orders, how to use them, common pitfalls to avoid, and how they can fit into a broader risk management framework.

Understanding Stop-Loss Orders and Why They Matter

At its core, a stop-loss order is a prearranged instruction to exit a position when the price reaches a certain level. By setting a stop price below your entry for long positions or above your entry for short positions, you ensure that your losses are limited if the market moves against you. This discipline protects your account from emotional decision-making in turbulent markets.

For a clear explanation of stop loss order mechanics, you can refer to this detailed guide on what stop-loss orders are and how they work in trading. Embedding this concept into your trading routine allows you to focus on strategy rather than reacting out of fear or greed.

Importantly, stop-loss orders are not just about loss prevention. They empower you to trade with defined risk, which is a foundational principle of successful trading. Knowing you have a plan for managing downside risk enables you to approach the markets with confidence and a clear mindset.

How Stop-Loss Orders Work in Practice

Imagine you buy a stock at $100 with the expectation that it will rise. You may decide that you are only willing to risk a 10% loss on this trade. By placing a stop-loss order at $90, your trade will automatically close if the price drops to that level. This means you know ahead of time the maximum loss you are prepared to take.

Stop-loss orders are simple in principle, yet the effectiveness of their application depends on thoughtful placement. If the stop is too close to your entry price, normal market fluctuations can trigger it prematurely, resulting in a loss even when the overall trend remains intact. If the stop is too far away, you may absorb larger losses than necessary, eroding capital that could be better protected.

Choosing the Right Stop-Loss Level

One widely used method is technical analysis. Traders often place stop-loss orders just below key support levels for long positions or above resistance levels for short positions. This approach acknowledges that breakouts beyond such levels may signal a significant shift in market sentiment.

Another method is using a percentage-based stop. This entails defining a fixed percentage loss you are willing to accept, such as 2% of your total capital. This approach brings consistency and discipline to your trading by standardising risk across different trades.

Volatility-based stops are also common, particularly in markets that experience large price swings. These stops use measures such as the Average True Range (ATR) to position stops at distances reflecting current market volatility. The idea is that in more volatile conditions, wider stops help avoid being stopped out by normal price variability.

Common Mistakes When Using Stop-Loss Orders

One frequent error is moving stop-loss levels further away after a trade goes against you, often described as “giving back” gains. This emotional response undermines your initial risk assessment and exposes you to larger losses.

Another mistake is using identical stop distances for every trade, regardless of market context. Markets vary in volatility, and what might be an appropriate stop in one environment could be too tight or too loose in another.

A third example of poor stop-loss practice is not using them at all. Some traders hope that markets will eventually reverse in their favour. However, without a definitive exit plan, small losses can compound into significant drawdowns, damaging both your account and your confidence.

Conclusion

Stop-loss orders are a cornerstone of responsible trading. They protect your capital, give structure to your risk management, and help you trade with clarity and discipline. By understanding how stop-loss orders work, selecting appropriate stop levels based on analysis and market conditions, and integrating them into a comprehensive trading plan, you stand a better chance of navigating markets with resilience and confidence.

Mastering stop-loss orders does not guarantee profit, but it significantly improves your ability to manage loss and trade with purpose. As you refine your approach and learn from experience, you will find that good risk management, anchored by the thoughtful use of stop-loss orders, can be one of the most empowering aspects of your trading journey.