Is CFD trading suitable for beginners?

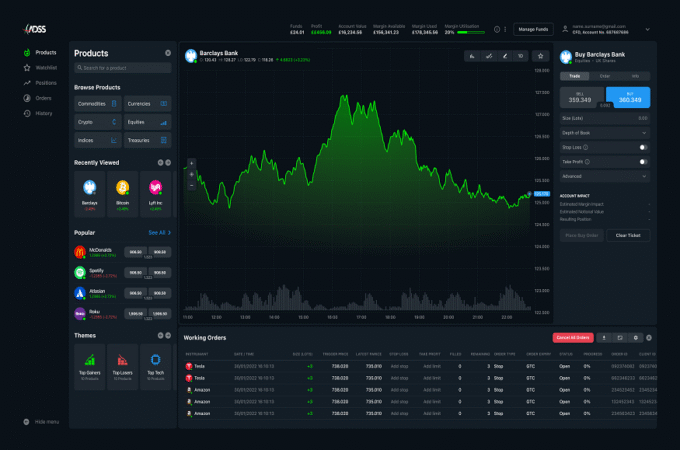

CFD trading is an abbreviation for Contract for Difference, a type of derivative trading. CFD trading allows traders to speculate on the price movements of different financial instruments without owning the underlying asset. Using leverage, traders can get exposure to more significant positions with a comparatively more minor investment. When trading CFDs, traders need not worry about the complexities involved in owning and holding assets like stocks or commodities as they are simply speculating on the possible price movement of an asset.

CFD trading has become an increasingly popular form of investing in recent years, and it’s not hard to see why. CFD trading allows investors in Japan to speculate on the future price movements of financial markets without owning the underlying asset. It is easy to start with CFDs, as no special requirements or qualifications are needed. Unlike traditional investments in Japan, such as stocks and bonds, where you need capital upfront and have more restrictions when buying and selling, CFD trading requires much less capital and can provide greater flexibility when executing trades.

Critical aspects of this type of investment beginners should be aware of

However, before taking the plunge into CFD trading, beginners must understand some key aspects of this type of investment. The first thing that a beginner should know is that CFD trading involves significant risk. As with any investment, it is essential to be aware of the risks of trading CFDs and to ensure you have the knowledge and experience to manage them. Additionally, as long positions are leveraged (i.e., investors borrow money from their broker to increase their exposure), a beginner must be comfortable managing leverage, which can lead to more significant losses.

Another thing newcomers should consider is the cost of trading CFDs. Generally speaking, CFD trades involve commission fees or spreads on each trade. It means that not only do traders need to factor in possible gains or losses when evaluating potential trades, but they also need to take into account the cost of each trade. Furthermore, some brokers may charge overnight financing fees if traders keep their positions open for longer than a day. It means that even when trades are advantageous, the cost of trading can significantly reduce returns.

Beginners should know that CFDs are not suitable for everyone and should weigh the risks before entering any trade. Besides considering individual risk tolerance levels, potential investors should also research the type of CFDs they want to invest in and look at some of the different strategies available to help them maximize their chances of success.

Beginner traders are also advised to use a reputable and experienced broker. It is an important step, as a broker can advise and guide new traders. Some brokers also offer educational materials and resources to help beginners get up to speed quickly.

What are the risks of CFD trading?

CFD trading has several risks that beginners should know before entering the markets. Firstly, CFDs are leveraged products, meaning that traders borrow money from their broker to increase their exposure, which can lead to substantial losses if not managed properly. It means that traders need sufficient knowledge and experience in managing leverage.

Another risk is market volatility, which can quickly affect the investment’s value. Since CFDs are based on the underlying asset’s price movements, investors must be prepared for sudden market changes. With CFD trading, it is also possible for leverage to work against you and for you, which may make it difficult for some beginners to determine when and where they should be placing trades.

In addition to market volatility and leverage issues, commission fees or spreads are associated with CFD trading, which can eat into potential funds. It means that even if your trades are lucrative in the long run, the cost of each trade may significantly reduce returns, so beginners need to research before entering into any CFD trades and understand how much they will pay in commissions or spreads if they take any positions.

Beginner traders must understand that CFDs carry inherent risks and ensure they are comfortable before investing capital. They should also look at different strategies and use a reputable broker who can advise on managing their trades and potential losses effectively.

Conclusion

CFD trading can be suitable for beginners if they understand the risks of this type of investment and are prepared to learn different trading strategies. Newcomers should also research different brokers and use those with experience in the field to ensure their trades are correctly handled. With the proper knowledge and understanding, CFD trading can be an effective way for beginners to start investing in financial markets without committing large amounts of capital upfront.