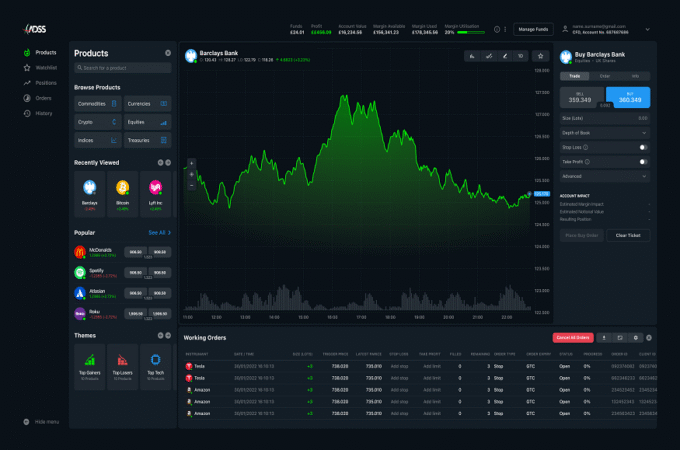

UK Dividend Investing: Precision Income Strategies in a Post-Rate-Hike Environment

The recent wave of interest rate hikes by the Bank of England has ushered in a new era for income-focused investors. Gone are the days of ultra-low yields and easy capital appreciation. In this evolving landscape, dividend investing in the UK demands more precision, deeper analysis, and a refined strategic approach.

For those looking to navigate this shift, understanding how dividend stocks perform in a high-rate environment and how to optimise their portfolios for reliable income is now more important than ever.

Understanding the Post-Rate-Hike

The Bank of England, in response to persistent inflationary pressures, has implemented multiple rate hikes since late 2021. These moves, intended to temper consumer spending and anchor inflation expectations, have dramatically altered the investment calculus.

Higher rates increase borrowing costs for businesses and consumers alike, impacting everything from corporate margins to mortgage affordability. Simultaneously, bond yields have become more attractive, providing credible alternatives to dividend-paying equities.

This shift has forced many income investors to re-evaluate traditional equity holdings. Stocks that once commanded premium valuations based solely on yield now face tougher scrutiny, particularly in sectors sensitive to interest rates.

Precision Income Strategies for UK Investors

In the current post-rate-hike environment, UK investors looking to generate sustainable income would be wise to prioritise dividend growth over headline yield. Chasing high yields can often lead to disappointment if those payouts prove unsustainable. A better approach is to target companies that consistently increase their dividends over time, as this typically reflects strong earnings momentum, solid free cash flow, and confident forward guidance from management.

Targeting Reliable Dividend Growth Sectors

Sectors like consumer staples, healthcare, and infrastructure tend to demonstrate reliable dividend growth. Companies such as Unilever and Diageo offer global reach and stability, while healthcare giants like AstraZeneca benefit from robust pricing power and steady cash flow. Infrastructure-related firms, including regulated utilities and toll road operators, also tend to deliver consistent dividends thanks to their inflation-linked pricing models.

Blending Defensive and Cyclical Dividend Stocks

Crafting a resilient income strategy also involves blending defensive and cyclical dividend payers. Defensive sectors—such as telecoms, utilities, and pharmaceuticals—offer stability during economic slowdowns, providing a reliable income anchor. Meanwhile, cyclical sectors like financials and industrials tend to outperform during recoveries. For instance, UK banks have recently enjoyed improved profitability from higher interest rates, supporting their ability to raise dividends. The right mix of these types of stocks should be adjusted based on economic conditions and monetary policy outlook.

Diversifying Across UK Large and Mid-Cap Stocks

Diversification between large-cap and mid-cap UK stocks adds another layer of income stability. While FTSE 100 companies like BP, GlaxoSmithKline, and National Grid offer high yields and global diversification, the FTSE 250 provides access to domestically focused firms with strong dividend growth potential. These mid-caps often present better growth opportunities and a lower correlation to global markets, making them valuable in a well-rounded portfolio.

Screening for Dividend Safety

Evaluating dividend safety is critical, especially when interest rates are high. Investors should examine the payout ratio to assess whether dividends are sustainable relative to earnings, and the dividend coverage ratio to gauge how comfortably earnings can support payouts. A strong coverage ratio—typically above 2—signals a healthier dividend. Likewise, a manageable debt-to-equity ratio and robust free cash flow indicate a company’s resilience in maintaining distributions.

Leveraging Dividend ETFs and Investment Trusts

For those who prefer a more hands-off approach, dividend-focused ETFs and UK investment trusts offer accessible routes to income investing. These vehicles provide diversified exposure to a range of dividend-paying companies, often with the added benefit of professional management and automatic dividend reinvestment to enhance long-term returns.

Popular choices include the iShares UK Dividend UCITS ETF (IUKD), City of London Investment Trust, and Murray Income Trust. When selecting among them, investors should consider historical yield performance, management fees, and sector allocations to ensure the product aligns with their income objectives.

For investors interested in building a sustainable income portfolio in the UK market, this comprehensive strategy combines dividend growth, sector diversification, financial scrutiny, and fund-based exposure. To deepen your understanding of dividend-focused investing, you can learn about it in greater detail.

Tactical Adjustments in Portfolio Allocation

As fixed-income assets regain traction in a higher-rate environment, many UK investors are rethinking how equities fit into their income strategies. Shifting capital between dividend-paying stocks, government gilts, and corporate bonds can reduce overall volatility while enhancing the reliability of returns. Instead of leaning too heavily on high-yield equities, investors may find value in trimming exposure to rate-sensitive sectors, allocating to short-dated bonds for capital preservation, and adding index-linked gilts to guard against inflation.

Changing interest rates also drive shifts in sector performance. Energy and financial stocks have recently outperformed, supported by strong commodity prices, cost discipline, and rising interest margins. In contrast, traditional income plays like REITs and utilities have struggled under the weight of higher borrowing costs and valuation pressures. By rotating into sectors better positioned for the current economic cycle, investors can maintain more stable dividend flows while unlocking capital appreciation potential.

Another powerful, often underutilised tool is the dividend reinvestment plan (DRIP). These allow dividends to be automatically reinvested into additional shares, amplifying compounding over time, particularly effective during market dips when stock prices are lower. Many UK brokers and trusts support DRIPs at no extra cost, although investors should keep in mind that reinvested dividends are still taxable unless sheltered within an ISA or pension.

Conclusion

Dividend investing in the UK remains a viable strategy for generating income, but it demands a shift in mindset. In a world where interest rates have reset and volatility is the norm, investors must emphasise quality, sustainability, and diversification.

Rather than simply reaching for the highest yields, successful investors will seek out resilient businesses with consistent dividend growth, strong fundamentals, and the ability to adapt to changing macroeconomic conditions.