Understanding Leverage in Margin Trading: A Comprehensive Overview

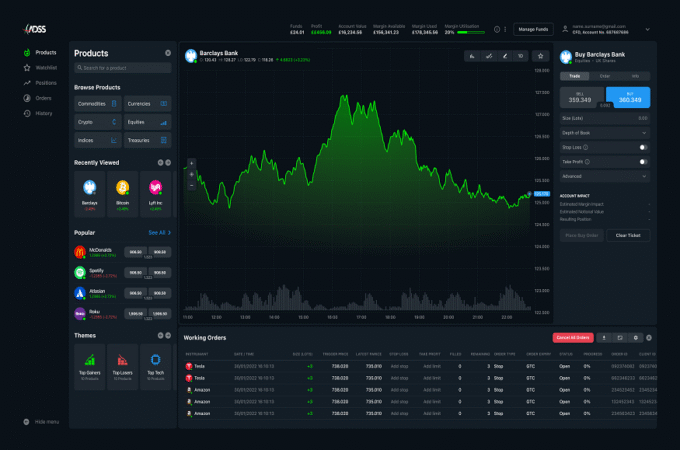

Leverage in margin trading is a powerful tool that allows traders to amplify their market exposure beyond their initial capital. It enables investors to control a larger position by borrowing funds from a broker, thus increasing potential profits—but also heightening risks. Understanding how leverage works is essential for both novice and experienced traders.

In margin trading, leverage is expressed as a ratio, such as 5:1 or 10:1, indicating how much a trader can borrow relative to their own funds. For example, with 10:1 leverage, an investor with $1,000 can control a $10,000 position. This magnification of capital can lead to substantial gains if the market moves favorably. However, it also means that losses are equally amplified, making risk management crucial.

A key concept in margin trading is the margin requirement, which refers to the minimum amount a trader must deposit to open a leveraged position. If losses reduce the account balance below a certain threshold, a margin call may be triggered, requiring the trader to deposit more funds or close positions to maintain the account. This is why risk management strategies, such as stop-loss orders and position sizing, are essential in leveraged trading.

While leverage provides opportunities for higher returns, it also increases volatility and the potential for significant losses. Traders should carefully assess their risk tolerance and ensure they understand the margin requirements set by their broker. Additionally, leverage ratios vary across different markets, with forex typically offering higher leverage compared to stocks and cryptocurrencies.

In conclusion, leverage in margin trading can be a double-edged sword. When used wisely, it can enhance profitability, but reckless use can lead to severe financial consequences. A disciplined approach, combined with proper risk management, is essential for success in leveraged trading.

3 in 1 Account Charges: The Ultimate Guide to Understanding Your Bank Fees

A 3-in-1 account is a bundled financial account that includes a savings account, a trading account, and a demat account. It allows seamless investment in stocks, mutual funds, and other securities. While convenient, these accounts come with various fees and charges that investors should understand to manage their finances effectively.

Types of a 3 in 1 Account Charges

- Account Opening Charges

Many banks charge a one-time fee for opening a 3-in-1 account. However, some banks waive this fee as a promotional offer. - Annual Maintenance Charges (AMC)

The demat account and trading account often have an AMC, which varies between banks. This fee covers the cost of maintaining your securities and transaction records. - Brokerage Charges

When you trade stocks, the bank charges a brokerage fee, which could be flat-rate or percentage-based. Discount brokers typically offer lower fees than full-service banks. - Transaction Charges

Every time you buy or sell securities, you may incur transaction fees imposed by the depository or the bank. This varies based on the trading volume and type of security. - DP (Depository Participant) Charges

When selling shares from your demat account, depositories like NSDL and CDSL charge a fee, which banks pass on to customers. - Other Fees

- Fund transfer charges (between savings and trading accounts)

- GST and taxes on transactions

- Penalty for non-maintenance of minimum balance in the savings account

Understanding these fees helps investors reduce unnecessary costs and choose a bank with competitive rates. Always compare charges before opening a 3-in-1 account to maximize your financial benefits!